Robert Gauthier / Los Angeles Times via Getty Images

The Florida Legislature is considering a move to eliminate property taxes in the state, a radical step that has the backing of Gov. Ron DeSantis.

If actually carried out, the proposal would make Florida the first state in the country without property taxes, a prospect that has already drawn strong reactions from both supporters and opponents.

A bill filed on Tuesday in the Florida Senate calls for a formal study of how eliminating real estate taxes could affect public services and the state’s economy and housing market.

Property taxes fund schools, parks, and emergency services. Florida has no income tax, and the proposed study would examine whether higher sales taxes could fill the funding gap if property taxes are eliminated.

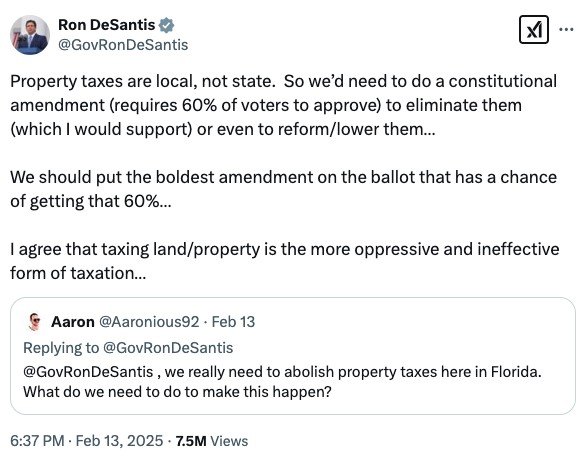

The new bill comes just days after DeSantis posted on X expressing his support for eliminating or drastically reducing property taxes in Florida.

“I agree that taxing land/property is the more oppressive and ineffective form of taxation,” the Republican wrote, responding to another user who asked if the taxes could be eliminated.

“Property taxes are local, not state. So we’d need to do a constitutional amendment (requires 60% of voters to approve) to eliminate them (which I would support) or even to reform/lower them,” wrote DeSantis. “We should put the boldest amendment on the ballot that has a chance of getting that 60%.”

Following the governor’s rallying cry, state Sen. Jonathan Martin, a Republican from Fort Myers, put forward SB 852, the bill calling for a study on the issue.

Martin’s bill calls on Florida’s Office of Economic and Demographic Research to study the feasibility of eliminating property taxes, and replacing lost revenue with budget cuts and sales tax hikes at the state and local levels. The report would be due on Oct. 1.

Spokespersons for Martin and DeSantis did not immediately respond to requests for comment from Realtor.com® this week.

Prior efforts to ban property taxes have failed

Currently, every U.S. state has property taxes, which are typically authorized by the state government, but set and collected at the city or county level.

Florida’s average effective real estate tax rate is 0.79%, which puts it almost exactly in the middle of the pack of the 50 states, according to WalletHub.

At Florida’s median home valuation level of $325,000 for tax purposes, that works out to annual taxes of $2,555 for the typical homeowner in the state, also around the middle of the pack.

Florida is already one of seven states without a state income tax, and has one of the lowest overall effective tax burdens in the nation. Florida’s general state sales tax rate is currently 6%.

The Sunshine State is not the first to consider eliminating property taxes.

In November, North Dakota voters squarely rejected a constitutional amendment to eliminate real estate taxes, after critics argued the step would have gutted funding for essential services.

Still, after years of rapidly rising property valuations and subsequent tax hikes, homeowner backlash against the levies has been rising.

In 2023, state and local governments collected about $760 billion in taxes on real and personal property, a 31% increase from 2018, according to U.S. Census Bureau data.

A number of other state ballot measures to cap or otherwise restrict property taxes did find support from voters last fall, indicating that the issue is gaining traction.

Pros and cons of eliminating property taxes

Ideally, the cost of property taxes is offset by the benefits to homeowners, who enjoy rising property values that are made possible by good schools, infrastructure, and services.

Homeowners often complain that it is unfair for them to shoulder the burden of paying for local government services.

However, renters also pay property taxes indirectly through their landlords, without reaping any of the benefits of the boost to home equity that comes from owning property in a safe, desirable location with well-regarded public schools.

Property taxes do add to the cost burden of homeownership though, and eliminating them could make purchasing a home more attainable.

“Florida ranks in the bottom half of states in terms of the amount of income needed to pay a mortgage before taxes, so this would help alleviate some of the burden that’s preventing Floridians from buying homes,” says Realtor.com senior economist Joel Berner.

“It would help first-time homebuyers get into the market by decreasing their monthly payment on a home, but replace that burden with higher sales tax that impacts lower-income buyers more than property taxes do,” he adds.