Getty Images

Future homebuyers in New York might soon get a boost.

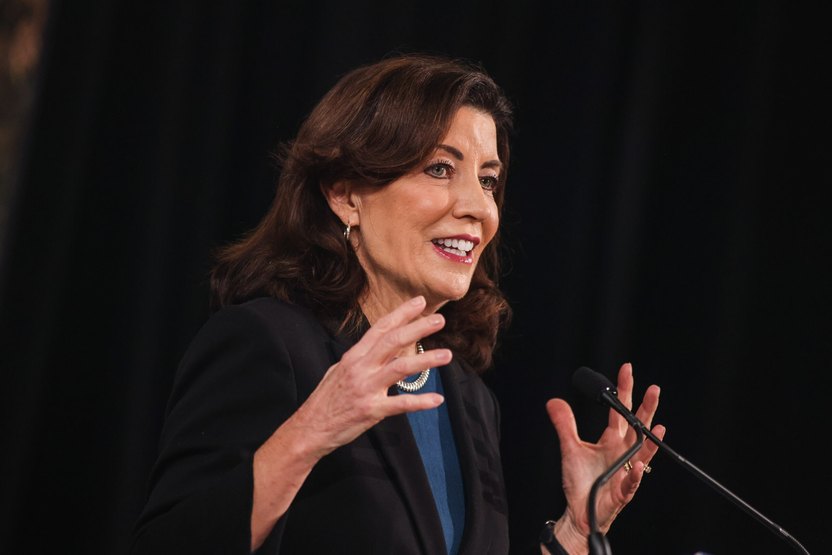

Gov. Kathy Hochul wants to help first-time homebuyers who are struggling to save up for a down payment.

In her State of the State address on Jan. 14, Hochul revealed $50 million has been budgeted to aid New Yorkers trying the achieve the American dream.

The median age for first-time homebuyers in 2024 was 38.

The governor did not give specifics on who would qualify for the down payment or how much they would receive, but her proposal will need to win approval by the New York State Legislature.

Steve Pfost/Newsday RM via Getty Images

Home, sweet home

At least 75% of Americans think owning a home is still part of the American dream, a recent survey by Realtor.com® reveals.

Today’s housing market poses a challenge for future buyers, though, as the median price for a home in the U.S. in December 2024 was $402,500.

In the New York metro area, that amount was higher, $749,000.

It also ranks among the five most expensive states to buy a home: 1) Hawaii, 2) Massachusetts, 3) California, 4) New York, and 5) Montana.

In the Realtor.com findings, there’s a generational difference in opinion when it comes to achieving homeownership.

Baby boomers are the most optimistic, at 41%, but only 27% of Gen-Z strongly agree that homeownership is attainable.

Steps to buying a home

The path to taking hold of the keys to your first home does not happen overnight.

The timeline can take anywhere from four to six months. That doesn’t include the time it takes to even find your dream home.

Many factors play a role, including inventory and how competitive the market is.

Currently, mortgage rates stand at 6.93% and inflation rose 0.3% in November 2024.

Realtor.com has a homebuying timeline to help your journey.

- Find a real estate agent: This person will know what’s required in your market and help you avoid delays and mistakes.

- Get pre-approved for a mortgage: This provides an edge over other buyers who are not pre-approved. Plus, it could be required to make an offer.

- Look through real estate listings: Finding The One could take longer than you expect, or it could be a quick process. It’s best to look through listings and compare what’s important to you when it comes to your future home.

- Schedule home tours: Your real estate agent can facilitate getting a tour of a potential property so you can see it in person.

- Make an offer: Once you find your future home, it’s time to make an offer. Your real estate agent will help get your offer to the sellers.

- Schedule a home inspection: Once your offer is accepted, you will need to schedule a home inspection. Buyers are advised to attend the inspection while it’s being done. It will give you insight into your future dwelling and allow you an opportunity to ask questions.

- Set up a home appraisal: A home appraisal is an unbaised professional estimate of your home. A mortgage lender needs this information to underwrite a loan.

- Get your loan approved: To save time for home loan approval, you want to get the necessary documents together. Most lenders will want to see recent pay stubs, W-2s, and tax returns for the past two years. Lenders will look over your credit reports and credit scores to determine if you can make your monthly mortgage payments on time.

- Closing: Your real estate agent will guide you on what you need to bring to closing. This day not only includes signing official paperwork but also handing over various payments to cover closing costs.