Getty Images

Given how tough the real estate market has been over the past few years, there’s a growing concern that owning a home is simply out of reach for most people these days, both young and old.

Despite the challenges, people continue to purchase homes every day—though it may take extra planning to make it happen.

But there are ways and means to safeguard you from the terrifying scenario of living “house poor.”

Using a tool like the Home Affordability Calculator on Realtor.com® can help you determine how much house you can comfortably afford based on your current budget.

How can I calculate how much home I can afford?

Realtor.com

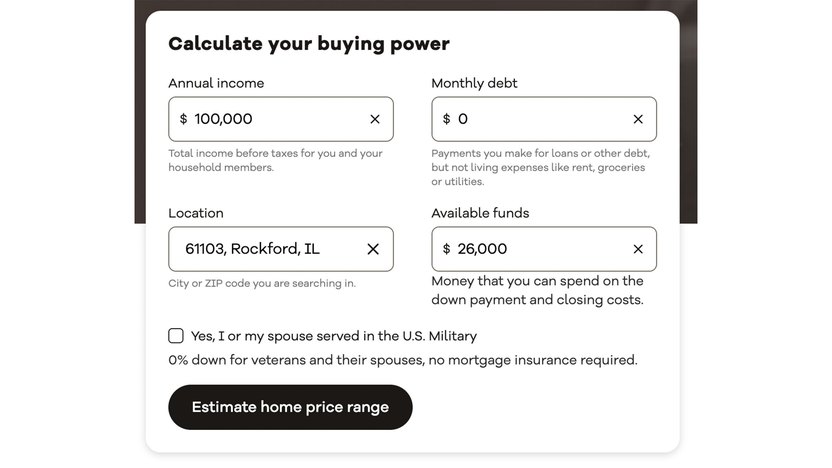

The Realtor.com affordability calculator will help you estimate how much you can afford to spend on a home when you’re considering buying a house.

First, you’ll enter your annual income before taxes and other deductions. That information can typically be found on your W-2 form. This could include salary, tips, wages, and commissions.

If there is anyone else in your household who will be contributing to the mortgage, add up all of your incomes to come up with the total income for the household.

Then, you’ll enter the total of your monthly debts. These are payments you make for loans, credit cards, or other debts—but not living expenses such as rent, groceries, or utilities.

Next, you’ll enter your available funds. This is how much money you have to spend on the down payment and closing costs.

Examples of available funds include bank accounts, personal loans, lines of credit, and investment accounts.

Then click the “estimate home price range” button to determine how much house you can afford.

It will list your buying power by giving you home price ranges in three categories: “affordable/fits your budget,” “stretch/stretches your budget,” and “difficult/over your budget.”

Then you can look at the Realtor.com free mortgage calculator to figure out monthly payments on a property you are considering.

This home loan calculator will help you determine if the property fits in your budget or not, and help answer the question “How much mortgage can I afford?”

You can plug in things like interest rates and the duration of the loan into the monthly mortgage calculator—and it’s also a down payment calculator, too.

Your goal in using this home payment calculator is to have your payment equate to 28% of your monthly income or less, which is a common guideline suggested by many financial experts.

How much house can I afford on my salary?

The answer varies, as we’ve explained. To make things easier, let’s zero in on a specific number. Let’s ask and answer, “How much home can I afford with a 100,000 salary?”

If you make $100,000 per year before taxes, you have $62,500 saved for a down payment and closing costs, and your monthly debts are presumably $650, a home up to $319,100 is considered affordable and fits your budget. A home from $319,101 to $385,000 stretches your budget. And a home from $385,001 to $443,100 and beyond is over your budget.

The math is based on one figure: that $62,500.

That’s how much a down payment and closing costs will realistically set you back on a conventional $250,000 loan.

“The standard has always been 20%, which helps you avoid private mortgage insurance, also known as PMI,” says real estate agent Ron Myers, of Ron Buys Florida Homes in Wellington, FL.

A 20% down payment on a $250,000 house is $50,000.

As for closing costs, plan to shell out 2% to 5% of the home’s purchase price.

On a $250,000 home, that’s about $5,000 to $12,500. This includes fees like the appraisal, title insurance, taxes, and lender fees.

“Always plan on the higher end so you’re not caught off-guard, and don’t forget to ask the seller if they’re willing to cover some costs,” says Myers. “It never hurts to negotiate.”

So for a $250,000 home, you’d need to have $50,000 saved for a 20% down payment, and $12,500 saved for closing costs. All that comes to a grand total of $62,500.

How do I determine my total monthly debts?

Your monthly debt is the sum total of all your recurring monthly expenses such as personal loans, car payments, student loans, minimum credit card payments, child support, and any other expenses that you would find on your credit report.

For example, if you had a $300 car payment, a $200 student loan payment, and a $150 minimum credit card payment, your monthly debt would be $650.

This is a crucial piece of the puzzle as well, because, well, every bill has to be paid.

Does debt-to-income ratio affect affordability?

Your debt-to-income (DTI) ratio is one way that lenders determine what size of monthly payments you can afford, and whether they are going to approve your mortgage loan or not.

Your DTI identifies the percentage of your gross monthly income (the amount you earn before tax) that goes toward your monthly debts. It’s estimated by dividing the total of your ongoing monthly debt payments by your monthly income before taxes.

A DTI score of 36% or less is often regarded as affordable by lenders.

Lenders frequently consider the higher your DTI, the more difficult it will be to make your monthly payments.

Generally, the lower your DTI, the greater the probability you will have of qualifying for a loan.

If you make $100,000 per year, that means you make $8,333 per month before taxes. Using the 28/36 debt-to-income rule, you shouldn’t spend more than 28% of your monthly income on housing-related expenses, or more than 36% on your debts (including your mortgage).

That means you wouldn’t want to spend more than $2,333 on house-related expenses ($8,333 X 0.28), or $3,000 on total debt ($8,333 X 0.36).

How much house can I afford with an FHA loan?

Buying a home with an FHA loan requires a 3.5% down payment when you have a credit score of at least 580.

A 3.5% down payment on a $250,000 loan is $8,750, and $12,500 for closing costs, which is $21,250 total.

If you make $100,000 per year before taxes and your monthly debts are $650, and you have $21,250 saved for a down payment and closing costs, a home up to $275,200 is considered affordable and fits your budget. A home from $275,201 to $336,900 stretches your budget. And a home from $336,901 to $401,600 and beyond is over your budget.

The DTI limits with an FHA loan are usually based on the “31/43” rule. That means that your monthly payments shouldn’t be more than 31% of your gross monthly income and your monthly debts shouldn’t be more than 43% of your gross monthly income.

So if you make $8.333 a month ($100,000 a year), your DTI shouldn’t be more than $2,499 ($8,333 X 0.43). This means you could afford a house payment that’s no more than $2,583 ($8,333 X 0.31).

How much house can I afford with a VA loan?

If you have served in the military, you may be eligible for a down payment of 0% with a VA loan.

A 0% down payment on a $250,000 loan is obviously zero—so you’d need to assume just $12,500 for closing costs.

In the Realtor.com affordability calendar, there is a box to check that says “Yes, I or my spouse served in the U.S. Military,” which calculates 0% down for veterans and their spouses, with no mortgage insurance required.

This gives you more buying power.

If you make a $100,000 annual salary, with $650 a month in debt, factoring in 0% down and $12,500 closing costs, a house up to $303,800 is considered affordable and would fit your budget. A house from $303,801 to $377,600 would stretch your budget. And a house from $377,601 to $448,800 and beyond would be over your budget.

Your monthly mortgage payment and monthly debts shouldn’t be more than 41% with a VA loan. So if you make $8,333 a month ($100,000 a year), your house payment plus debts shouldn’t be more than $3,416 ($8,333 X 0.41).

What else should I know about affording a house in this market?

Some last words of wisdom:

Finance guru Dave Ramsey recommends never paying more than 25% of your take-home pay toward housing.

You are the one writing the checks, so only you know what you are comfortable with long-term. But most people don’t want to be “house poor.”

“Don’t buy the max dollar you’re approved for,” recommends real estate agent Rachel Kilmer, of Lee’s Summit, MO. “In most cases, that approval will make it extremely difficult to afford the cost of living.”

Myers agrees: “Don’t max out your budget. Life happens, and you don’t want to be choosing between your mortgage and fixing your car.”

A good emergency fund is key, too.

“Owning a home often comes with surprises and unexpected expenses. Being prepared makes all the difference,” says real estate Andrew Fortune, of Great Colorado Homes in Colorado Springs, CO.

And don’t be afraid to start small.

“With the increase in interest rates over the last few years, people have started to buy starter homes again,” says Brian Durham, managing broker at Realty Group in Minneapolis. “There is nothing wrong with starting with a smaller single-family home, townhome, or condo, gaining some equity while paying down your mortgage, and, when the time is right, selling that home and moving that equity into the next property that fits your needs at that time.”