MLS/Realtor.com (2)

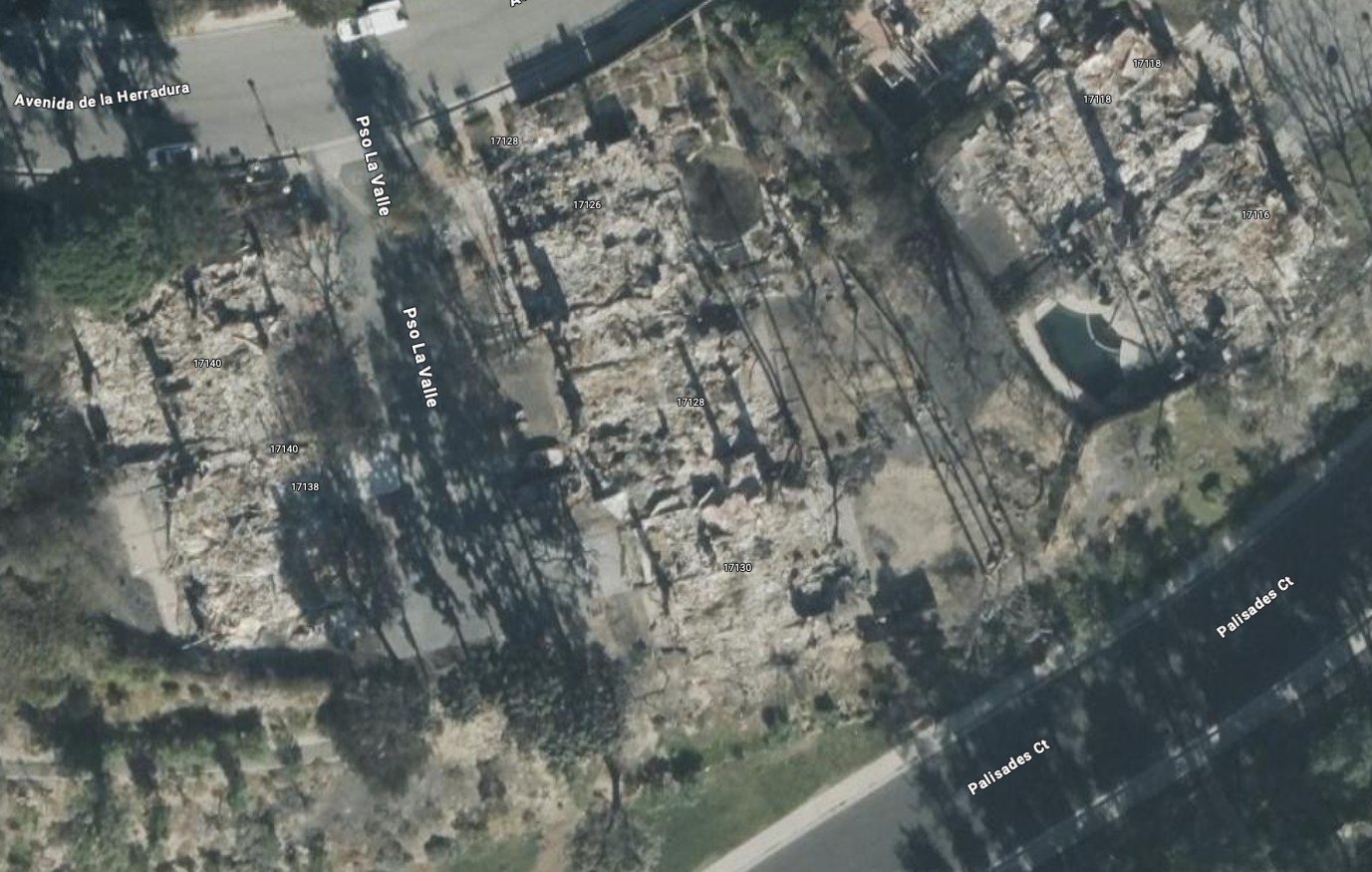

A plot of land in the wildfire-ravaged neighborhood of Pacific Palisades has officially been sold for $1.18 million—nearly $200,000 more than its original listing price—as dozens of other torched properties hit the market for up to $3.25 million each.

Realtor.com® revealed that the original Palisades plot, which was once home to a four-bedroom, three-bathroom dwelling that was decimated by the Palisades Fire in January, was initially listed for $999,000 just days after the house burned to the ground in the devastating blaze.

However, after being inundated with interest from prospective buyers, that number was steadily pushed up, ultimately landing at just under $1.2 million.

Despite its listing agent, Richard Schulman, of Schulman Team/KW Advisors, admitting that no access was being granted to homes in that area—and no clear timeline of cleanup efforts had yet been made available—the land sold in just 34 days, becoming the first fire-ravaged property to be snapped up by a buyer.

Schulman tells Realtor.com that the property has been purchased by a “local investor,” after it was put on the market by its previous owner almost immediately after the fires broke out.

(AGUSTIN PAULLIER/AFP via Getty Images)

(Google Maps)

(Realtor.com)

While many questions remain as to the true extent of the property damage caused by the fires—and the true cost that homeowners will face in their efforts to rebuild—Schulman notes that this seller had no reservations about putting her decimated home on the market.

“For her, it’s an easy decision, and this made the most sense for her,” he told Realtor.com when the land was originally listed. “She was absolutely clear she was not going to rebuild. She’s staying nearby.”

While the property is understood to be the first of its kind to sell in the wake of the fires, it appears to be far from the last—with Realtor.com records indicating that 12 other scorched plots have since been listed, almost all of which have been listed with even larger price tags.

Of the dozen of plots that have been brought to the market in the last seven days, seven have asking prices of more than $2 million, with the most expensive currently listed for $3.25 million.

Only one—a $749,000, 3.14-acre plot that was once home to a two-bedroom, two-bathroom residence—has been listed for less than $1 million.

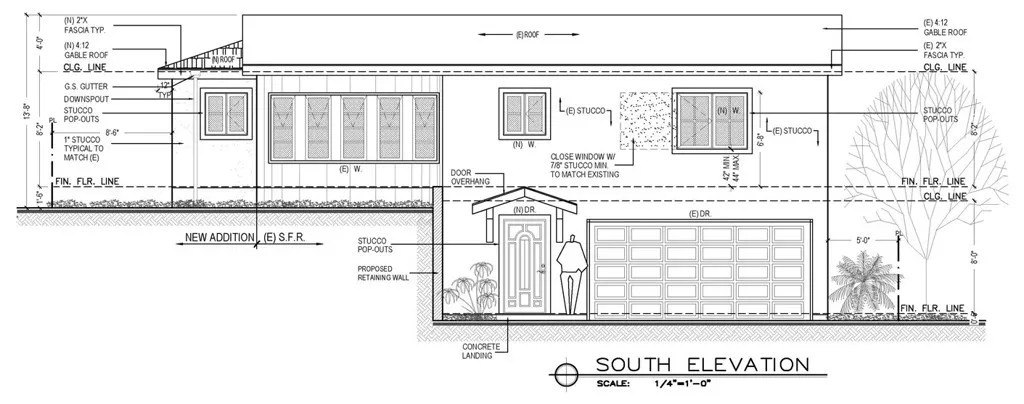

The most expensive listing, which offers just 0.4 acres, urges potential buyers to “be part of the rebuild,” noting that the lot allows for a 5,660-square-foot home to be constructed on the land.

A similar trend has also emerged in Altadena—another area of Los Angeles that was hit hardest by the fires—with 12 new land listings appearing on the market since Jan. 29, albeit for slightly lower prices than those in the Palisades.

Several of the listings have been posted with no imagery, while others include plans for a potential rebuild—or stark photos that reveal the charred remains of the homes that were decimated by the fires.

Some hold images of signs indicating that the removal of the property’s hazardous materials has been completed.

The surge in land listings in these areas paints a rather dire picture for the future of the fire-ravaged communities, indicating that many residents have made the decision to move on rather than rebuild—a process that local real estate agent Brock Harris previously revealed could take up to five years.

“At least one-third to half of the owners in Altadena are unwilling or unable to rebuild a house,” Harris previously told Realtor.com. “And when they look at their net proceeds from the insurance on their lot sale, this makes sense to take their money and move on, and leave the building up to a professional who will build the home and get a resident back in it much faster than they could have.”

(Realtor.com)

(Google Maps)

(Realtor.com)

Harris added that his firm was getting calls every day from potential sellers who lost their homes in the fire and were weighing their options.

“We’ve spoken to people with very small children,” he said. “We spoke to people who are senior citizens. These are not people who are able to rebuild a home, or able to rent in the three to five years it takes to build a new home, so they’re mostly happy to leave it to someone else and to take the money and move on.”

Industry experts are split over the future of those communities that were most severely impacted by the fires, with celebrity real estate agent Josh Altman claiming in multiple interviews that up to 70% of Pacific Palisades residents will not return to the area.

He pointed to the fact that many will be put off by the idea of living in a “fire area” that may not be fully rejuvenated for years, while others have grown “fed up” with the struggle to secure insurance for homes located in high-risk areas.

However, Barbara Corcoran, founder of The Corcoran Group, was quick to criticize this estimate, insisting that “100% [of Palisades residents] are coming back.”

Igniting in early January, the Palisades and Eaton fires, driven by powerful Santa Ana winds, scorched through a combined total of more than 37,000 acres. By the time the blazes were finally contained more than three weeks later, they killed at least 29 people and ravaged over 16,240 homes and businesses.

A recently released report from the UCLA Anderson Forecast put the estimated property and capital damage from the Palisades and Eaton fires alone at between $95 billion and $164 billion, with insured losses potentially reaching a jaw-dropping $75 billion.

The UCLA report’s authors acknowledged that the estimates laid out in their report are based on various assumptions and may be subject to future revision.

UCLA economists Zhiyun Li and William Yu, who co-authored the report, emphasized that their insured losses figure “does not represent the full cost to property owners.”

(Realtor.com)

(Realtor.com)

According to the report, insurance policies may not cover all expenses related to the fire, and homeowners without mortgages may not have insurance coverage at all.

On Feb. 19, California Gov. Gavin Newsom attempted to mitigate the financial toll being faced by homeowners whose properties were destroyed in the fire by proposing a mortgage relief package that totals more than $125 million.

Newsom’s plan earmarks more than $100 million in direct mortgage assistance for homeowners at risk of foreclosure and whose property was either destroyed or heavily damaged as a result of a declared emergency since Jan. 1, 2023.

An additional $25 million would go toward extending an existing program that provides mortgage counseling and offers guidance on FEMA disaster assistance to help victims get back on their feet.

“As survivors heal from the trauma of recent disasters, the threat of foreclosure should be the last thing on their minds,” the governor stated. “This disaster mortgage relief program would help lift this burden and give families more time to focus on recovery.”

Funding for the relief package would come from existing settlement funds that then-California Attorney General Kamala Harris secured from multiple mortgage servicers a decade ago, resolving allegations of misconduct during the Great Recession of 2007–09.

Newsom’s office stressed that the mortgage assistance plan would not affect the state’s budget.

The program is not limited to victims of the Palisades and Eaton fires.

Survivors of past disasters, including the Park Fire that wreaked havoc in Northern California’s Butte and Tehama counties in July 2024, and the Franklin Fire that scorched the wealthy enclave of Malibu in December 2024, also would be eligible to apply for help.