Dai Sugano/MediaNews Group/The Mercury News via Getty Images; Getty Images

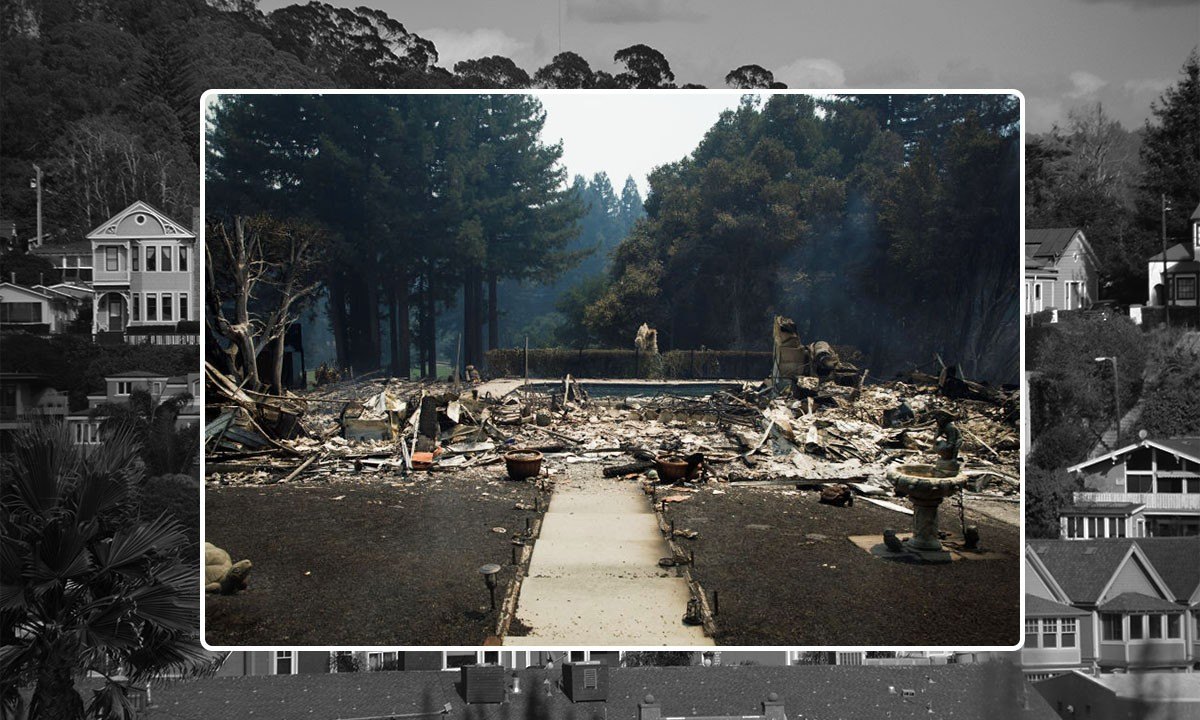

Ana Wold, a single mother from Northern California, had been saving up for years to buy her first home, but she got to enjoy it for only a month before it was annihilated by a fast-moving wildfire that scorched its way down the Santa Cruz Mountains in August 2020.

More than four years later, Wold, 51, the owner of a wine bar in Santa Cruz, is more than $450,000 in the red, after fighting with her insurance company, her mortgage lender, the public adjuster, and the contractor she had hired to rebuild her dream home in the town of Boulder Creek, who then sued her when she ran out of money.

“And I don’t even have a house to show for it. I have nothing to show for it,” Wold told Realtor.com® in a recent phone interview.

Wold is not alone. The CZU Lightning Complex fire, which ignited on Aug. 16, 2020, destroyed about 700 homes in Santa Cruz County, before it was fully contained more than a month later.

As Santa Cruz Sentinel first reported, citing information from the county, only 127 houses affected by the inferno have since been rebuilt and an additional 134 were still under construction.

While Wold and some of her neighbors were struggling to pick up the pieces, a new round of wildfires driven by powerful Santa Ana winds overwhelmed Los Angeles County in early January, killing at least 29 people, decimating the communities of Pacific Palisades and Altadena, and causing possibly up to $164 billion in property and financial losses.

(Ana Wold)

(Ana Wold)

Response to January fires raises questions

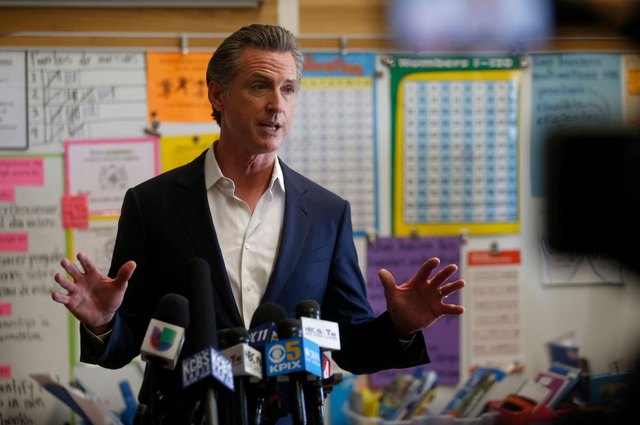

Just days after the deadly blazes ignited, California Gov. Gavin Newsom issued an executive order to suspend permitting and review requirements under the California Environmental Quality Act and the California Coastal Act in a bid to help the victims of the Palisades and Eaton fires rebuild quickly.

Another executive order followed on Feb. 13 to further streamline the permitting process, with Newsom pledging to not “let overly strict regulations get in the way of rebuilding these communities.”

This week, Newsom proposed a mortgage relief package totaling more than $125 million that would benefit victims of recent natural disasters. The plan earmarks millions of dollars in assistance for homeowners at risk of foreclosure and whose property was either destroyed or heavily damaged as a result of a declared emergency since Jan. 1, 2023.

(LinkedIn)

Wold said the contrast between Newsom’s response to the recent disaster in L.A. and the CZU fire in 2020 was glaring.

“It’s very hurtful for all of us,” she said. “We’re not getting that help, and it would’ve been nice if we had gotten that help. … I only got a total of $5,000 from FEMA. That is all.”

Wold said that even before her rebuilding efforts ground to a halt due to a lack of funds and became mired in litigation, the entire process from the beginning had been very costly and “convoluted.”

Wold said she had paid about $10,000 to the city of Santa Cruz in several installments for various permits needed to rebuild her home.

The experience had also been hampered by inadequate guidance from the county’s Fire Recovery Center, she added.

“I had to call them quite a bit of times to get them to explain the process to me and get them to explain what was going on and what I needed to do,” she said. “It is a very confusing process. Nobody tells you what to do.”

She was left feeling like she was “floundering and just trying to make it happen as fast as you can, because none of us are contractors.”

(Getty Images)

Damning grand jury report reveals errors

Other Boulder Creek residents who lost their homes in the 2020 inferno have similarly complained of having to deal with a tangle of red tape.

An excoriating 26-page civil grand jury report issued by Santa Cruz County in June 2024 found that “a substantial number of those who lost their homes simply walked away without rebuilding.”

Others, like Wold, found themselves under-insured to the point “that they simply could not bear the cost to rebuild,” or they were unable to “navigate a lengthy and often bewildering permitting process.”

In some cases, homeowners abandoned their rebuilding aspirations simply because they were not made aware of the resources available to them.

The grand jury concluded that the county’s response to the disaster was lacking, compounded by California’s insurance crisis, the outbreak of the COVID-19 pandemic, and the impacted area’s challenging terrain.

According to the report, county agencies did not have an effective disaster response plan in place, causing many victims “to incur unnecessary expense in the rebuilding process.”

After the devastating blaze was put out and the rebuilding process got underway, the grand jury found that the County Planning Department was too understaffed to effectively deal with the avalanche of new building permit requests.

Victims who were interviewed for the report unanimously agreed that contact with the planning department “was extremely frustrating” and unhelpful.

“They reported feeling hopeless and/or ready to abandon their plans to rebuild,” the report read.

The majority of victims were either uninsured or underinsured. And even those who were fortunate enough to have a comprehensive policy had to wait months, and in some cases years, for their claims to be processed and for payouts to begin flowing into their bank accounts.

As victims waited for their claims to go through, the cost of building a home nearly doubled during the pandemic, from $200 to $300 per square foot to $700 to $800, according to the report.

“When insurance payouts were finally made, funds were no longer enough to cover the cost to rebuild their home,” the grand jury concluded.

Before anyone could start rebuilding anything, they were required to obtain “pre-clearance” permits related to environmental health, fire access, and geologic hazards, which the grand jury described as a potentially “arduous and expensive” process that could cost up to $22,500.

That amount does not take into account instances in which a property did not pass an inspection and needed upgrades to bring it up to code, which could set a homeowner back hundreds of thousands of dollars in additional costs.

Tiffany Martinez, a spokesperson for the Santa Cruz Department of Community Development and Infrastructure, sought to defend the county’s response to the wildfire, telling Realtor.com in a statement that in 2021, the Recovery Permit Center was established to help victims navigate insurance and FEMA claims, building, fire and environmental codes, local rules, and other issues associated with the rebuilding process.

“CZU Fire victims received priority permitting, expedited reviews, reduced permit fees, and walk-in consultations,” she stressed.

“We recognize that the rebuilding process can be complex and timelines may differ depending on the project, but our goal remains to provide as much guidance and support as possible,” Martinez added.

Homeownership dream turns into a nightmare

For Wold, however, her experience was a textbook case of everything that has gone wrong with the post-CZU fire rebuilding.

Wold started 2020 feeling “on top of the world,” she said. She had just bought her first home in Boulder Creek for $505,000 and her business, a wine bar called Vino by the Sea on a Santa Cruz wharf, just two weeks apart.

“I was ecstatic and thinking how wonderful it was that all my hard work had paid off, because I was able to save money and do these two things, and then literally a month later, I lost everything,” she said.

A proud first-time homeowner in August 2020, Wold made improvements to her new home, installing custom ceiling fans, upgrading her bathroom, and ordering new furniture for herself and her son.

“I had struggled and scrimped and saved over the years, and so now that I was in a position where I had all of the savings, I wanted to treat myself and take all new things into my home,” she recalled.

One morning in mid-August, Wold’s brand-new dining table was still in its box, sitting in the kitchen waiting to be unpacked and assembled, when the CZU fire raced down from a ridge behind Boulder Creek.

While Wold, who had evacuated along with some 70,000 Santa Cruz residents, was at work at her day job as a sales director in San Jose, the flames consumed much of the Boulder Creek community, including her red-doored home and all of her possessions.

It was not until a month later that Wold said a kind police officer guarding the scene allowed her to go up the mountain to survey the devastation.

“Everything was gone,” she recalled. It was only the beginning of her troubles.

Wold was among the lucky Californians who had private home insurance, instead of the state’s insurance of last resort, the FAIR Plan. However, after the fire, she discovered her insurance broker had made a colossal mistake in her policy. As a result, her property ended up being “severely underinsured” for only $284,000, she said.

“That’s not going to build a house anywhere, let alone in California, let alone during COVID,” Wold pointed out.

Unwilling to give up on her dream of homeownership, and bolstered by a public adjuster’s assurances that she could get more money out of her insurance company, Nationwide, Wold plowed ahead with rebuilding.

By December 2021, she had teamed up with a prefabricated homebuilding company and hired a contractor, aiming to move into her new, fire-resistant panel home by Christmas 2022.

But by August of that year, Wold said she learned that no more money would be coming from Nationwide. She filed a lawsuit, but ultimately received only $100,000, which was not enough to complete rebuilding her home.

With Wold’s new home only halfway built, the contractor she had hired put a lien on the house, erected a gate around it, and locked her out, she recalled. Then the contractor sued Wold personally for $700,000.

“I can’t make any progress on my home, because I’m now trying to figure out what the hell I’m going to do, and so my house is just sitting there,” Wold said. “But in the meantime, I’m having to still make mortgage payments, and then on top of that, my insurance company is now no longer paying for a place for me to live.”

After a three-year legal battle, Wold said she agreed to pay the contractor $150,000—to end the costly legal process.

“I did nothing wrong. I did not ask for this fire. I did not ask for this to happen,” she said.

Wold is now trying to sell her Boulder Creek property with the unfinished home for $580,000, before her mortgage deferment plan runs out in mid-March.

Wold has been renting while trying to get back on her feet, but she said she has not given up on owning her own home in the future, ideally close to the ocean.

“I would like to buy another home eventually, when I’m able to save money and recover from this nightmare,” she said.

Wold also had a warning for those who lost their homes in Los Angeles County in January.

“My advice to everybody in L.A. who’s going through this is know what you’re going to get from insurance first, before you start building,” she said. “Don’t go in on a hope and a prayer, like I did.”